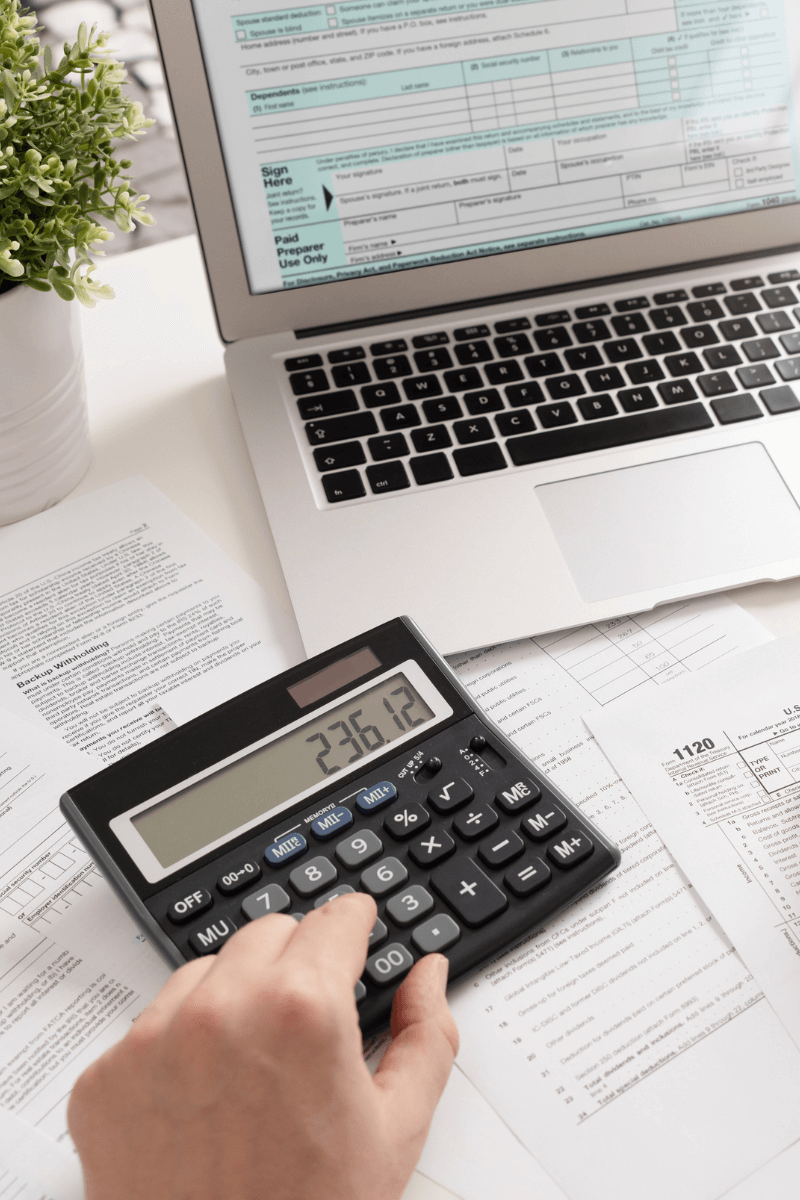

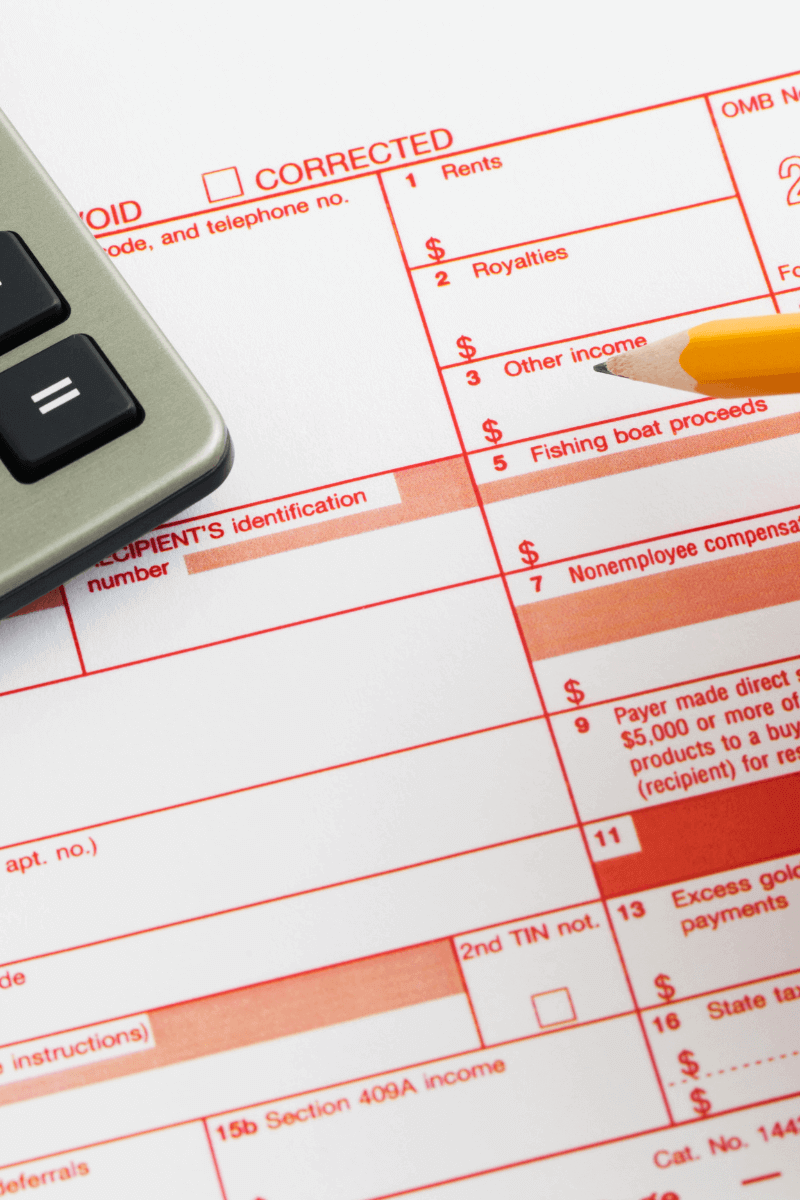

Accounting Best Practices: Ensuring Tax Compliance

Ensuring tax compliance in your business is critical to avoiding costly penalties and legal issues. Many business owners find tax compliance daunting due to the ever-changing tax laws and regulations. However, failure to comply can severely impact your business’s financial health. To avoid potential issues, be sure to follow best practices for tax compliance, including […]